| Currency | Buy | Sell |

|---|---|---|

| USD | 16,278.00 | 16,528.00 |

| EUR | 19,127.00 | 19,321.00 |

| GBP | 22,142.00 | 22,336.00 |

| AUD | 10,663.00 | 10,857.00 |

| CNH | 2,205.00 | 2,399.00 |

| JPY | 110.54 | 112.48 |

| SGD | 12,691.00 | 12,885.00 |

| HKD | 2,010.00 | 2,204.00 |

The Excellent Performance Bank - in 2024 (KBMI 2)

CCB Indonesia received "The Excellent Performance Bank in 2024" (KBMI 2), from Infobank magazine on 29 August 2025.

Indonesia Best Bank 2025

CCB Indonesia received "Indonesia Best Bank 2025 for Accelerating Sustainable Corporate and Consumer Financial Services, category KBMI 2 Private Foreign from Warta Ekonomi magazine on 25 June 2025.

Best Performance Bank KBMI II Category

CCB Indonesia received "Best Performance Bank KBMI II category" award from Bisnis Indonesia Daily on 18 September 2024

The Excellent Performance Bank in 2023 (KBMI 2)

CCB Indonesia received "The Excellent Performance Bank in 2023 (KBMI 2), from Infobank magazine on 29 August 2024.

Indonesia Best Bank 2024

CCB Indonesia received "Indonesia Best Bank 2024¡± for Strategies Implementation through business development, category KBMI 2 Private Foreign Banks¡¯ from Warta Ekonomi magazine on 31 July 2024.

Corporate Internet Banking Product/Service Information Summary

|

Publisher Name |

: |

PT Bank China Construction Bank Indonesia Tbk |

|

Product Name |

: |

Mobile Banking CCB Indonesia |

|

Product Type |

: |

Mobile Banking |

|

Target Customer |

: |

Individual Customers |

|

Product Description |

: |

Mobile Banking (MB) service, is one of the electronic banking services from CCB Indonesia to individual customers to provide ease of banking transactions through the internet network without the need to come to CCB Indonesia Branch Office. |

|

Main Features |

|

|

Benefit |

|

|

Risk |

|

|

Limit |

||

|

Transaction Type |

Transaction |

Daily |

|

Overbooking IDR |

IDR 100 mio |

IDR 300 mio |

|

Online Transfer (IBFT) |

IDR 25 mio |

IDR 300 mio * |

|

SKN-BI |

IDR 100 mio |

|

|

RTGS |

IDR 300 mio |

|

|

BI-FAST |

IDR 50 mio |

|

|

Purchase |

IDR 1 mio |

IDR 5 mio |

|

Payment |

IDR 10 mio |

IDR 20 mio |

|

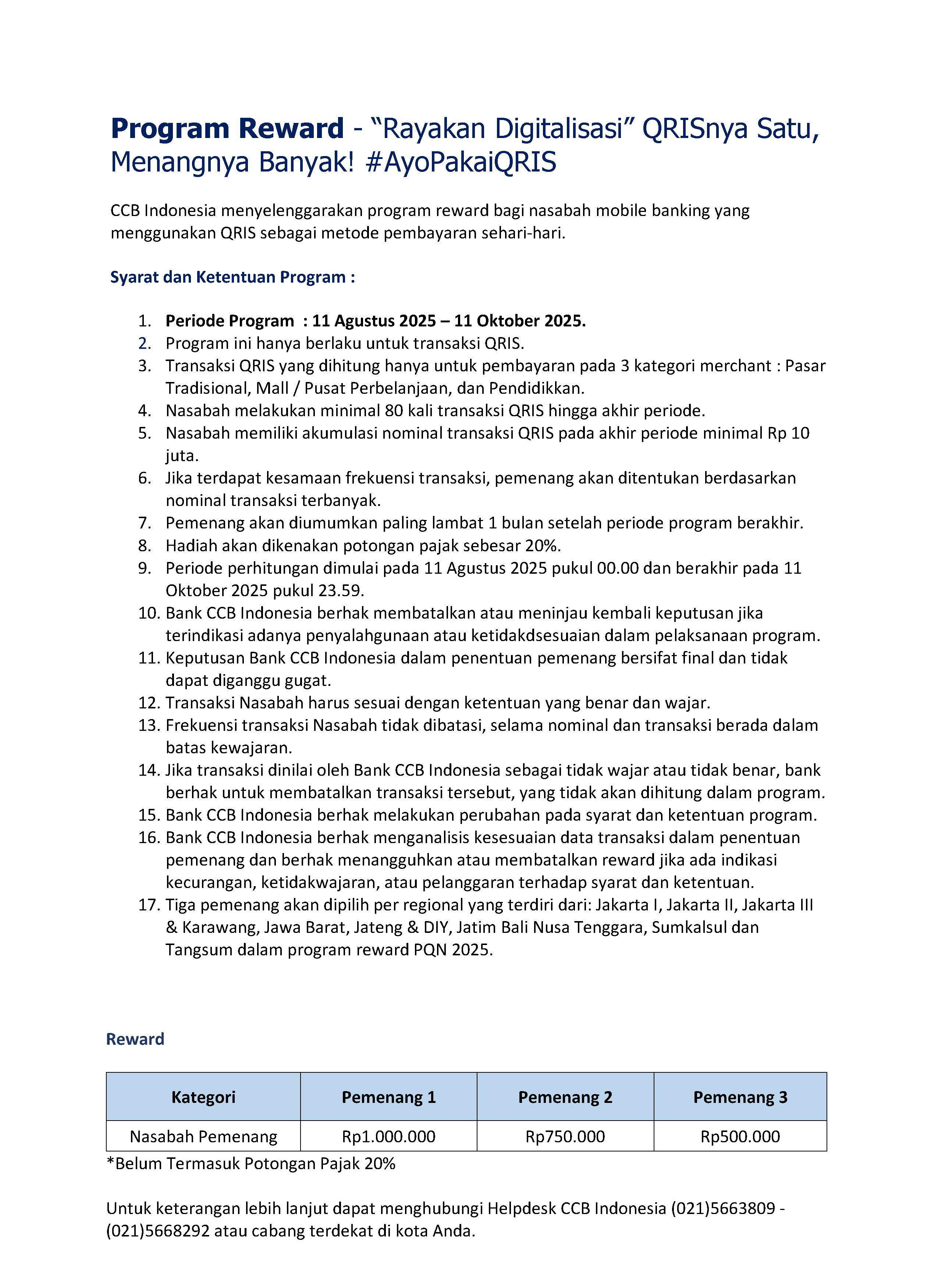

QRIS |

IDR 10 mio |

IDR 25 mio |

|

Overbooking USD |

USD 3,500 |

USD 7,000 |

|

Overbooking SGD |

SGD 4,500 |

SGD 9,000 |

|

Overbooking CNY |

CNY 20,000 |

CNY 40,000 |

|

Top Up e-Wallet |

IDR 1 mio |

IDR 5 mio |

|

Requirements and Procedures |

|

|

Cost |

|||||||||||||||||

|

|

QRIS |

|||||||||||||||

|

|

Internet Banking service is conducted in the territory of the Republic of Indonesia. PT Bank China Construction Bank Indonesia Tbk is licensed and supervised by the Financial Services Authority. |